There’s no denying that denials are a significant challenge in the revenue cycle process. When you’re not paid for the services you’ve provided, your organization’s financial health is compromised, and, in turn, the quality of patient care you provide is at risk of being negatively impacted.

In fact, claim denials cost hospitals upwards of ~$20M annually, according to an analysis conducted by Beckers. The survey found that respondents identified an average denial rate of 15%, yet the ideal hospital denial benchmark is 5-10%.

Denials cost money, time, and resources and create risks for penalties and audits, leading to more money, time, and resources being spent unnecessarily.

To put this in perspective, let’s consider our customer with 165 beds as an example:

- In January, they had 6,367 encounters, 200 of which were psychology department claims.

- If, on average, each psychology claim reimburses $2,000, should 10% of those claims be denied, that’s $40,000 in missing revenue – just in one month, in one department.

How much are you missing out on and how can you reduce denials?

The Causes of Hospital Denials

The complexity of the claim process lends itself to a myriad of reasons you could receive a denial.

In this blog, we will highlight:

- The top reasons for denials – and how to avoid them

- Hospital denials benchmarks for professional fee claims – what to strive for and the impact on your overall operations

- How the Medaptus Charge Pro solution can help you catch common errors before they’re sent to billing, in turn reducing denials

Top Reasons for Hospital Denials and How to Reduce Them

1. Eligibility Issues

Eligibility issues result from incorrect insurance coverage or lack of verification. An eligibility denial may occur because of missing or inaccurate information, services not covered by the carrier, or outdated/expired insurance, among other reasons.

We suggest using custom code configurations and payer-specific flags and adapting an exception-based coding workflow to address these issues.

Custom code configurations help ensure you have met the rules of specific insurance carriers, such as a diagnosis code not being allowed as the primary code. For example, you could have a rule to hold charges that are missing parent codes or modifiers or to hold codes that are not compatible with a specific place of service.

Charge Pro also provides payer-specific flags offering a visual alert for individual insurance company requirements.

For charges with a high risk of denial, you can set up a custom rule to automatically hold them until a coder can review them. For example, the Medaptus system can identify a charge where insurance hasn’t been recorded and put it on hold for review. This way, you can address the missing information before submitting the claim.

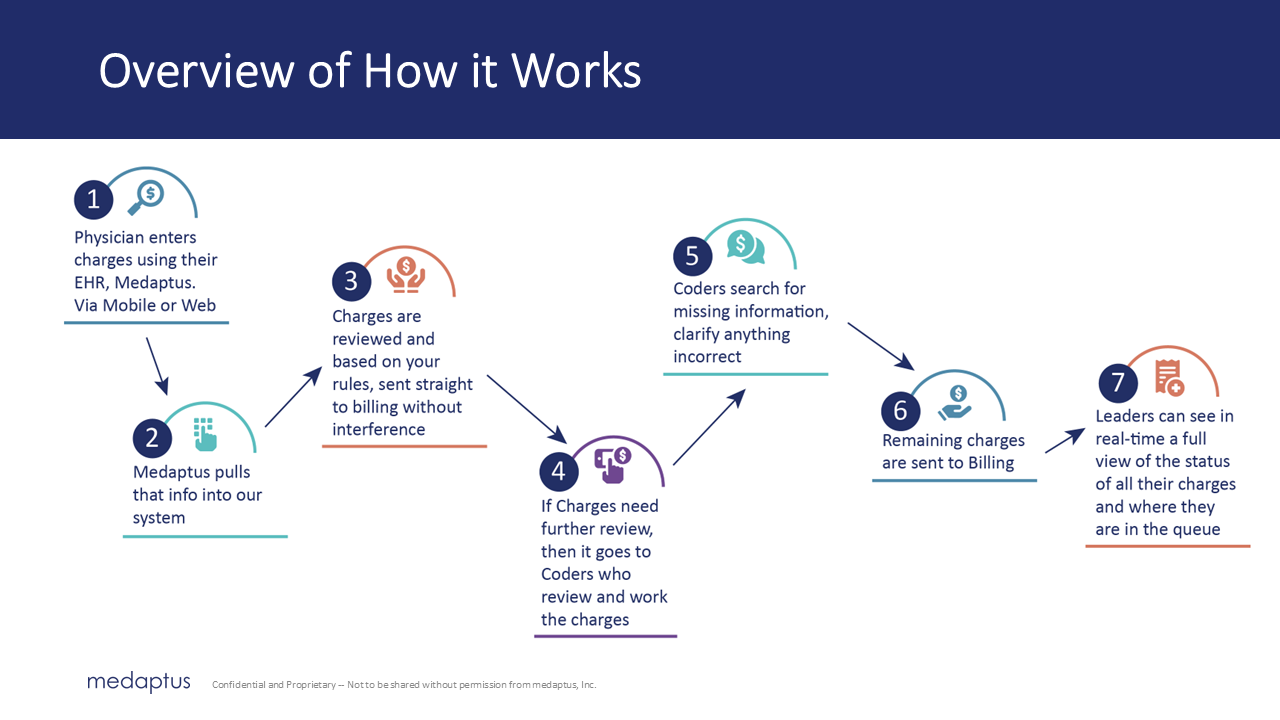

Our exception-based coding saves you time. Only those charges that you’ve determined require review will be put on hold. Standard charges will automatically be sent to billing without human intervention – allowing you to focus on the more complex cases.

2. Lack of Proper Authorization

Another common reason for claim denials is failing to get and submit proper insurance authorizations for procedures requiring prior approval.

You will want to rely on an authorization code flag in this scenario. The system will identify cases where you may not have recorded the authorization code and, thus, are facing a denial.

3. Incorrect Service Bundling

Incorrect service bundling occurs when services have been improperly grouped together or billed separately when they are meant to be grouped.

Mistakes can occur when modifiers are misused or missing or when incorrect visit or procedure codes are selected.

Applying modifier rules correctly is the key to avoiding coding errors. For instance, billing 99214 (an established office visit) alongside G0439 (a wellness visit) will trigger a CCI violation. To resolve this, you must use a 25 modifier to bill appropriately.

4. Incompatible Codes

Billing incompatible codes together can lead to denials. Here are a few examples:

- 99381-99397 CPT codes cannot be billed with Medicare

- V00-Y99 diagnosis codes cannot be listed as the primary diagnosis

- A CCI flag would be when 99396 is billed with 90471; it needs a modifier

In Charge Pro, you can configure rules to catch these incompatible codes and hold them before they’re sent to billing. Does your current charge capture system automatically hold charges that have incompatible codes?

5. Duplicate Claims

When two providers within one group bill the same patient on the same day, you’re dealing with a duplicate claim. Alternatively, there are also duplicate claim cases involving the same provider using multiple E&M codes.

Charge Pro will place a hold on same-service date claims so that you can easily choose the best and most profitable to submit for reimbursement.

The list doesn’t end there. Denials are prone to human error, including the following:

Communication between providers and coders.

- Charge Pro offers messaging to allow for ease of clarification.

Incomplete documentation.

- Charge Pro can be integrated into your EHR making it easier to reference the documentation and ensure charge entry is reflective of services provided.

Using incorrect or missing modifiers.

- Charge Pro has over 100 standard rules inherent to the system and the flexibility to create numerous custom rules.

Delayed completion and submission of charges

- Charge Pro offers a charge grid, a visual indicator of where charges are missing or incomplete. Reports are also available to review coder productivity and total lag time.

Confusion when referencing multiple systems and/or paper processes

- Charge Pro is the bridge between your systems and easily integrates with existing software, providing interoperability between your EHR and Billing via secure HL7 interfaces.

Referencing outdated material

- Ensuring your Charge Description Master (CDM) is up-to-date and accurate based on CMS guidelines is key to avoiding denials. Medaptus partners with FinThrive to keep up with CMS guidelines. Our team maintains this in Charge Pro, and your platform will show outdated codes in red to highlight their expiration and need for maintenance.

How to Reduce Denials | Improving Denial Rates

If you’re not meeting the hospital denials benchmark rate of 5-10%, then it’s time to analyze the causes of your denials and take action to reduce denials. Here are the first few steps to start your analysis:

- Categorize your denial types. Are they coding-related denials? Missing information?

- Analyze the prevalence of those types across months to a year of data. How often do you see the same types of denials?

- Analyze any trends. Are there any providers that have higher rates of denials than others? Are you exceeding the hospital denials benchmark of 10%?

- Take action to prevent denials. What preventative solutions can we employ to help us avoid denials?

Ensure you have the proper tools and processes in place to accurately manage charges and identify errors before submitting for billing.

Final Notes

Not only are claim denials an administrative burden, but they can also have a significant financial impact, with the potential for delays or no reimbursement at all.

Learn more about lowering your hospital denial rate and how you can get aligned to a better hospital denial benchmark rate. Book a demo of Charge Pro today.

Get the latest updates and news delivered to your inbox.

Subscribe to our newsletter today.